Excess Liquidity in Banking System, Slow Credit Flow to Private Sector

Author

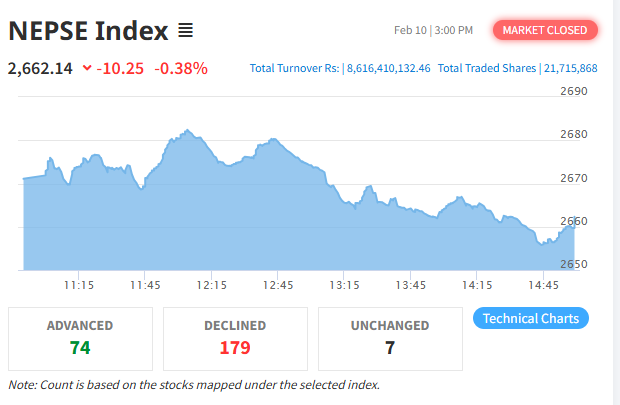

NEPSE TRADING

In the current fiscal year, credit flow from banks and financial institutions to the private sector in Nepal has remained weaker than expected. Despite a significant increase in deposits, low demand for loans from businesses and industries has intensified the problem of excess liquidity in the banking system.

According to Nepal Rastra Bank, interest rates have fallen to historically low levels. Although the central bank issued bonds to manage long-term liquidity, the expected outcomes have not been achieved. Even after absorbing nearly NPR 200 billion in liquidity in recent months, pressure on interest rates persists.

Recent data shows that total deposits in banks and financial institutions have reached NPR 7.697 trillion, while total credit stands at only NPR 5.783 trillion. As a result, around NPR 1.144 trillion remains as excess liquidity. The credit-to-deposit ratio is currently limited to 74.37 percent.

The central bank has used various monetary tools such as deposit collection auctions, standing deposit facilities, and bonds to absorb liquidity. However, some funds have re-entered the system through overnight facilities, keeping net liquidity at a high level.

During the review period, private sector credit increased by only 3.6 percent, lower than the growth recorded in the previous year. Most of the loans were directed toward non-financial institutional sectors, while lending to individuals and households remained limited.

In terms of loan categories, margin lending, import-related trust receipts, hire purchase, and cash credit loans recorded moderate growth. However, real estate and term loans showed weak expansion. Meanwhile, the high share of institutional deposits has made liquidity management more challenging for banks.