IMF Advises Caution as Non-Performing Loans Rise in Nepal’s Financial Sector

Author

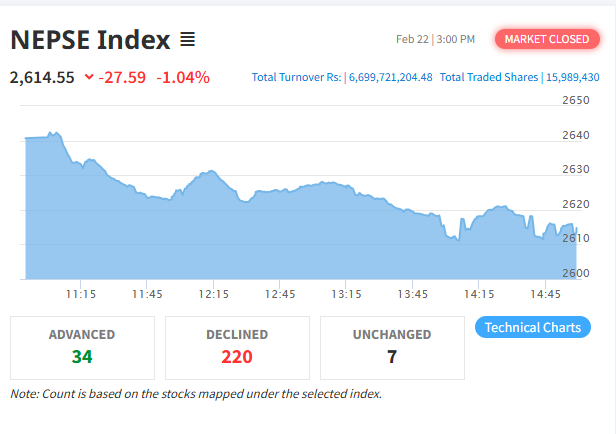

NEPSE TRADING

Kathmandu — The International Monetary Fund (IMF) has warned that rising non-performing loans (NPLs) are increasing risks in Nepal’s financial sector and called for greater vigilance. During its seventh review mission under the Extended Credit Facility (ECF), the IMF noted that NPLs have reached 5.4 percent and could rise further based on loan portfolio reviews, potentially weakening banks’ capital positions. The IMF emphasized the need to strengthen regulatory and supervisory frameworks, improve asset quality assessment, and address weaknesses in loan classification and provisioning. Following discussions with Governor Bishwanath Paudel and the Nepal Rastra Bank, the IMF recommended enhancing bad loan recovery strategies, incorporating international best practices in establishing an asset management company, and amending the central bank law to strengthen autonomy and governance. Upon approval by the IMF Executive Board, Nepal is expected to receive USD 43.2 million in financial support. While acknowledging progress in reforms, the IMF cautioned that political uncertainty, weak capital expenditure, and financial sector vulnerabilities continue to pose risks to economic stability, stressing the need for sustained policy reforms.