Nepal Rastra Bank Tightens Dividend Distribution Rules for Microfinance Institutions

Author

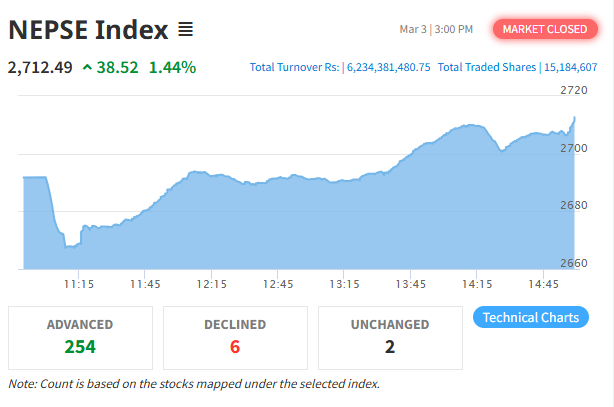

NEPSE TRADING

Nepal Rastra Bank has tightened regulations on dividend distribution by microfinance institutions that fail to maintain the prescribed paid-up capital. The central bank has clarified that such institutions will not be allowed to distribute cash dividends except for tax purposes. According to the new provision, dividend limits are determined based on the level of non-performing loans (NPLs) and the capital adequacy ratio maintained after dividend distribution. Microfinance institutions with NPL ratios below 5 percent, between 5 to 10 percent, and between 10 to 15 percent may distribute dividends only within the limits set according to their capital position, while institutions with NPLs exceeding 15 percent are barred from distributing dividends altogether. Based on capital adequacy and NPL status, eligible institutions may distribute dividends ranging from 5 percent up to a maximum of 25 percent. The central bank expects this policy to strengthen financial discipline, improve risk management, and protect the interests of depositors and investors in the microfinance sector.