Nepal Rastra Bank to Collect NPR 50 Billion in Deposits

Author

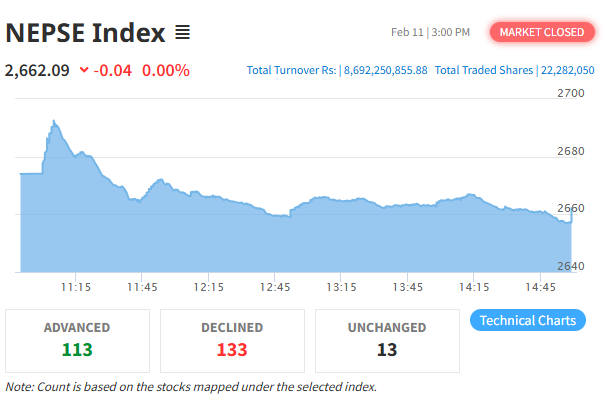

NEPSE TRADING

Kathmandu. Recently, the Nepalese banking system has faced a challenge in managing the excess investable capital that has accumulated. A decline in demand for loans, a slowdown in economic activity, and the inability of banks to channel loans into investable sectors have led to a large accumulation of funds in the banks.

In this context, the Nepal Rastra Bank (NRB) has decided to collect NPR 50 billion in deposits for 46 days. The central bank is using the bidding process to collect this amount. With increased liquidity, the interbank interest rate has dropped to 2.75%. To prevent the interest rate from falling below the lower limit of the interest rate corridor, NRB has been continuously absorbing money from the market. Nearly NPR 500 billion collected earlier through deposit collection instruments is still maturing.

According to NRB, the deposit collection process will take place through an online bidding system. Banks and financial institutions can submit their bids by 3 PM today. The interest rate will be determined through the bidding process, and the principal and interest payments will be made on 15th Chaitra 2082 (April 1, 2026).

Banks and financial institutions wishing to participate in the deposit collection process can bid with a minimum of NPR 100 million and a maximum of NPR 500 million, in accordance with the total amount being called. The NRB has also made provisions for multiple bids at different interest rates.

When distributing the funds, priority will be given to the institution with the lowest interest rate bid. Subsequently, higher interest rate bids will be accepted until the total called amount is fulfilled. Only banks and financial institutions with NRB authorization in categories ‘K’, ‘Kh’, and ‘G’ will be allowed to participate in this deposit collection.

Over NPR 8.5 trillion in NRB

With the financial system maintaining high liquidity (investable capital), NPR 8.5 trillion has accumulated at the Nepal Rastra Bank. The central bank has raised liquidity from the market using deposit collection instruments, permanent liquidity facilities, and NRB bonds.