शेयर बजारको मूल्य कसरी निर्धारण हुन्छ ? — माग र आपूर्तिको सन्तुलनले खेल्छ मुख्य भूमिका

Author

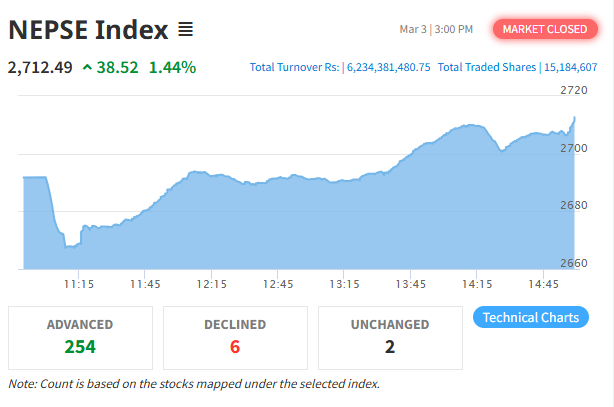

NEPSE TRADING

शेयर बजारको मूल आधार नै माग र आपूर्ति हो । बजारमा कुनै कम्पनीको शेयर किन्न खोज्ने लगानीकर्ताको संख्या बढेमा त्यसको मूल्य बढ्छ । त्यसको विपरीत, बेच्नेहरू बढी भए मूल्य घट्ने स्वाभाविक प्रक्रिया हो । यही सन्तुलनले बजार मूल्यलाई दैनिक रूपमा चलायमान बनाउँछ ।

विश्लेषकहरूका अनुसार बजारमा कम्पनीको वित्तीय प्रदर्शन, लगानीकर्ताको मनोविज्ञान, र समग्र आर्थिक वातावरणले पनि मूल्यमा प्रभाव पार्छ । ठूला संस्थागत लगानीकर्ताले ठूलो मात्रामा खरिद अर्डर राख्दा तत्काल विक्रेता नपाइएपछि मूल्य अस्थायी रूपमा माथि जान सक्छ । पछि बजार सन्तुलनमा फर्किँदा मूल्य पुनः स्थिर हुने गर्छ ।

खरिद–बिक्रीको सन्तुलनमै निर्धारण हुन्छ मूल्य

शेयर बजारमा प्रत्येक खरिदका लागि एउटा बिक्री आवश्यक हुन्छ । खरिदकर्ताको संख्याले बिक्री दबाबभन्दा बढी हुने बित्तिकै मूल्यमा वृद्धि आउँछ । संस्थागत लगानीकर्ताहरूका ठूला कारोबारले बजारको तत्कालीन आपूर्ति–माग सन्तुलन बिगार्दा मूल्यमा उल्लेख्य उतार–चढाव देखिन्छ ।

बजारमा जब खरिदकर्ता धेरै हुन्छन्, मूल्य उकासिन्छ । विक्रेता बढी भए मूल्य घट्छ । खरिदकर्ता र विक्रेता बराबरी अवस्थामा पुगेमा मूल्य सानो दायराभित्र स्थिर रहन्छ । यसरी, बजारको निरन्तर हल्ला माग र आपूर्तिको सन्तुलनमै आधारित रहन्छ ।

शेयर बजार के हो ?

शेयर बजारलाई सामान्यतया यस्तो मञ्च मानिन्छ जहाँ कम्पनीहरूले पूँजी जुटाउन आफ्ना शेयर सार्वजनिक रूपमा बिक्री गर्छन् । लगानीकर्ताले ती शेयर खरिद गरी कम्पनीमा सह–मालिकको हैसियत पाउँछन् । शेयरको मूल्य बढ्ने अपेक्षामा लगानीकर्ताले बजारमा प्रवेश गर्छन् ।

कम्पनीहरूले इन्भेस्टमेन्ट बैंकमार्फत प्रारम्भिक सार्वजनिक प्रस्ताव (Initial Public Offering — IPO) ल्याएर शेयर बिक्री गर्छन् । लगानीकर्ताले यी शेयर खरिद गरेपछि उनीहरू कम्पनीका आंशिक मालिक बन्छन् । सोही कारण उनीहरूलाई कम्पनीको नाफाबाट लाभांश प्राप्त गर्ने र नीतिगत निर्णयमा सहभागिता जनाउने अधिकार हुन्छ ।

शेयर बजारबाट नाफा कमाउने उपाय

शेयर बजारमा नाफा कमाउने प्रमुख तीन माध्यम रहेका छन् । पहिलो, कम्पनीले नाफाबाट वितरण गर्ने लाभांश (Dividend) हो । दोस्रो, कम्पनीको समग्र मूल्यवृद्धिसँगै शेयर मूल्यमा हुने वृद्धि हो, जसलाई अर्गानिक ग्रोथ भनिन्छ । तेस्रो, बजारमा उपलब्ध शेयरको संख्यामा कमी आउँदा बाँकी शेयरको मूल्य बढ्ने अवस्था हो, जसलाई इनअर्गानिक ग्रोथ मानिन्छ ।

यी माध्यमहरूबाट लगानीकर्ताले प्रत्यक्ष वा अप्रत्यक्ष रूपमा नाफा आर्जन गर्न सक्छन् । तर, बजार जोखिमयुक्त भएकाले हरेक लगानी सोच–विचारपूर्वक गर्नुपर्ने सन्देश विज्ञहरूले दोहोर्याउँदै आएका छन् ।

कसले गर्छ सहभागिता ?

शेयर बजारका सहभागीलाई सामान्यतया दुई वर्गमा बाँडिन्छ — ट्रेडर र इन्भेष्टर । ट्रेडरहरूले छोटो अवधिका उतार–चढावमा नाफा खोज्छन् । उनीहरू प्राविधिक विश्लेषण र चार्टका आधारमा द्रुत निर्णय लिन्छन् र उच्च जोखिम वहन गर्न तयार हुन्छन् ।

इन्भेष्टरहरू भने दीर्घकालीन सोच राख्छन् । उनीहरू कम्पनीको वित्तीय अवस्था, नाफा क्षमताको विश्लेषण र भविष्य सम्भावना हेरेर लगानी गर्छन् । उनीहरूको जोखिम सहने क्षमता मध्यम वा कम हुने गर्छ ।

मूल्याङ्कनको तरिका

शेयर मूल्याङ्कन (Valuation) भन्नाले कम्पनी वा शेयरको वास्तविक वा सैद्धान्तिक मूल्य पत्ता लगाउने प्रक्रिया हो । लगानीकर्ताले भविष्यमा बजार मूल्य कहाँ पुग्न सक्छ भन्ने अनुमान गर्छन् ।

सामान्य रूपमा, कम मूल्यांकन (Undervalued) भएका शेयर भविष्यमा बढ्ने सम्भावना भएकाले किनिन्छन् । अत्यधिक मूल्यांकन (Overvalued) भएका शेयर घट्ने सम्भावना भएकाले बेचिन्छन् । यसरी बजारमा अन्डरभ्यालु शेयरहरू माथि र ओभरभ्यालु शेयरहरू तल जान्छन् ।

सफल लगानीका लागि आधारभूत ज्ञान अपरिहार्य

शेयर बजारमा सफल हुनका लागि सूचित निर्णय, योजनाबद्ध रणनीति र जोखिम बुझ्ने क्षमता अनिवार्य मानिन्छ । बजार कसरी चल्छ भन्ने आधारभूत बुझाइले लगानीकर्तालाई विवेकपूर्ण निर्णय गर्न मद्दत पुर्याउँछ ।

विशेषज्ञहरूका भनाइमा, बजार ज्ञानविहीन लगानीकर्ताले अल्पकालीन हल्लामा चल्ने सम्भावना बढी हुन्छ । त्यसैले, शेयर बजार प्रवेश अघि माग–आपूर्तिको सिद्धान्त, मूल्याङ्कन विधि र जोखिम व्यवस्थापनबारे जानकारी लिनु जरुरी हुन्छ ।

यो विषयमा प्रकाशित लेखले बजारको चाल, मूल्य निर्धारणको सिद्धान्त, र लगानीकर्ताको भूमिकाबारे व्यापक जानकारी दिएको छ । बजार कसरी काम गर्छ भन्ने बुझाइले नयाँ लगानीकर्तालाई सचेत बनाउने र दीर्घकालीन लगानी संस्कार विकासमा टेवा पुर्याउने अपेक्षा गरिएको छ ।