EBON Approves New Margin Trading Directive; Implementation from mid-February

Author

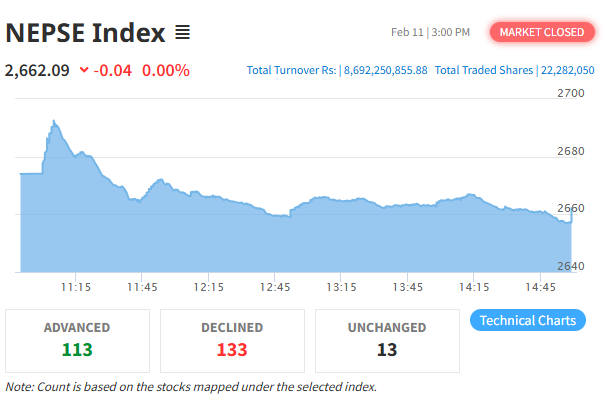

NEPSE TRADING

KATHMANDU — In a major move to boost liquidity and expand investment avenues in the capital market, the Securities Board of Nepal (SEBON) has approved the 'Margin Trading Facilities Directive, 2026 (2082 BS)'. Replacing the previous 2017 guidelines, the new directive is set to come into effect on February 13 (Falgun 1).

Under the new provisions, stockbrokers are now empowered to provide credit directly to investors for purchasing shares. This "Margin Trading" facility allows investors to purchase stocks by depositing a portion of the total cost as "Initial Margin," while borrowing the remainder from the broker.

Strict Eligibility for Companies

To safeguard investors and prevent speculative bubbles in weak stocks, SEBON has set rigorous eligibility criteria for companies. Only companies that meet the following standards are eligible for margin trading:

Listing History: Must have been listed on NEPSE for at least two years post-IPO.

Share Volume: At least 2.5 million units of ordinary shares (excluding lock-in shares) must be listed.

Financial Health: The company's net worth must be equal to or higher than its paid-up capital.

Profitability: The firm must have posted a net profit in at least two of the last three fiscal years.

Broker Requirements and Risk Management

Not all brokers are permitted to offer this service. Only those with a minimum paid-up capital of Rs. 200 million and those acting as clearing and depository participants are eligible. Furthermore, brokers must obtain prior approval from the Nepal Stock Exchange (NEPSE) and can extend credit up to five times their certified net worth. To ensure diversification, a broker cannot lend more than 10% of its total margin limit to a single client or their family.

The "Margin Call" Mechanism

The directive introduces a robust "Marked-to-Market" system. Investors are required to maintain an Initial Margin of 30%. Should the market value of the stocks fluctuate, a Maintenance Margin of 20% must be upheld. If the value drops below this 20% threshold, brokers are mandated to issue a "Margin Call," requiring the investor to deposit more funds or collateral. Failure to do so grants the broker the legal right to sell the shares to recover the loan.

Transparency and Market Impact

To ensure transparency, brokers must maintain separate "Margin Trading Accounts" and "Margin Trading Demat Accounts." All daily margin transactions must be reported to NEPSE by the following day for public disclosure. Additionally, an annual audit of margin operations must be submitted to the Board.

SEBON anticipates that this move will significantly increase capital flow in the secondary market, allowing small and medium-scale investors to increase their buying power. It also provides a new revenue stream for brokers through interest income, reducing their sole reliance on trading commissions.