External Sector Strengthens, but Domestic Economic Momentum Remains Sluggish

Author

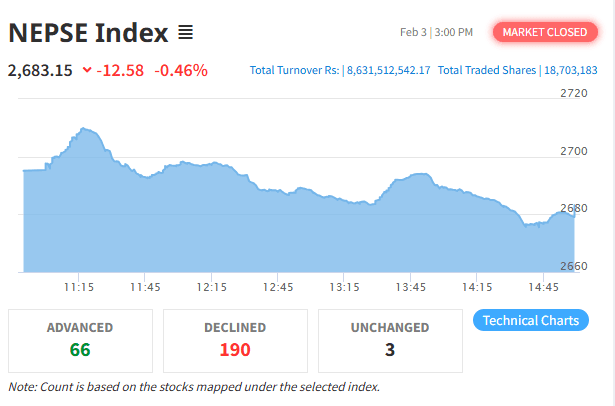

NEPSE TRADING

Kathmandu — Data released by Nepal Rastra Bank for the first six months of the current fiscal year presents a mixed picture of Nepal’s economy. While most external sector indicators have strengthened noticeably, internal economic activity continues to lag behind expectations, pointing to an uneven recovery.

Low inflation, a strong foreign exchange reserve position, and a sharp rise in remittance inflows have emerged as major positive developments. However, these gains have not yet translated into stronger private sector credit expansion, investment, or consumption. As a result, industrial and commercial activities remain subdued despite improved macroeconomic stability.

After facing significant challenges in recent years due to high inflation, external payment pressures, and liquidity constraints, Nepal’s economy appears to have moved toward a relatively stable path by the middle of the current fiscal year. The latest figures suggest that immediate macroeconomic risks have eased, though deeper structural weaknesses persist within the domestic economy.

According to the central bank, annual point-to-point consumer inflation stood at 2.42 percent during the review period, a notably comfortable level compared to recent years. This indicates reduced price pressure on consumer goods and reflects effective monetary management. Contained inflation has helped ease the burden on households, even as overall economic activity remains weak.

Foreign exchange reserves have reached NPR 3,242.45 billion, equivalent to USD 22.17 billion. This level of reserves is sufficient to finance approximately 18.1 months of merchandise and services imports, making it one of the strongest external buffers Nepal has recorded in recent years. Economists view this as a key safeguard against external shocks in the near term.

On the trade front, exports increased sharply by 43.8 percent, while imports rose by a relatively modest 14.2 percent. At the same time, government expenditure reached NPR 690.22 billion, while revenue mobilization stood at NPR 577.40 billion, highlighting continued pressure on fiscal balances.

The strong reserve position—capable of covering more than 18 months of imports—is considered the most encouraging external sector indicator. Rapid export growth combined with a surge in remittance inflows has kept both the balance of payments and the current account in surplus, significantly reducing the risk of short-term external instability.

During the review period, the current account recorded a surplus of NPR 429.91 billion, while the balance of payments surplus stood at NPR 501.24 billion. Remittance inflows increased by 39.1 percent in Nepali rupees and 32.3 percent in US dollars. In the month of Poush alone, remittances worth NPR 192.62 billion entered the country, providing crucial support to household income and external stability.

Despite these favorable external indicators, domestic economic activity remains weak. Sluggish growth in private sector credit suggests that industries, trade, and investment have yet to regain full momentum. Although bank deposits continue to rise, slow credit expansion indicates weak demand for investment, even in an environment of ample liquidity.

Monetary indicators show that broad money supply increased by 5.4 percent during the review period and by 14.2 percent on an annual basis. Bank and financial institution deposits grew by 5.7 percent, while credit to the private sector expanded by only 3.6 percent. On an annual basis, deposit growth stood at 14.8 percent, whereas credit growth was limited to 6.7 percent, underscoring the gap between available funds and actual investment demand.

Fiscal performance also remains under strain. Revenue mobilization has failed to keep pace with government targets, while expenditure growth has remained relatively strong. This imbalance continues to exert pressure on public finance management. With interest rates currently at low levels, analysts argue that more effective policy measures are needed to channel liquidity toward productive private sector investment.

Overall, the data suggest that Nepal’s economy is stable but not yet strong. External indicators are robust, inflation is under control, and the financial system appears sound. However, without a revival in production, investment, and job creation, the economy cannot be considered fully resilient. Turning the current stability into sustainable growth will require structural reforms and stronger, private-sector-friendly policies—posing both a challenge and an opportunity for policymakers.