Ghalemdi Hydro Reports Rising Losses in Second Quarter, Financial Pressure Deepens

Author

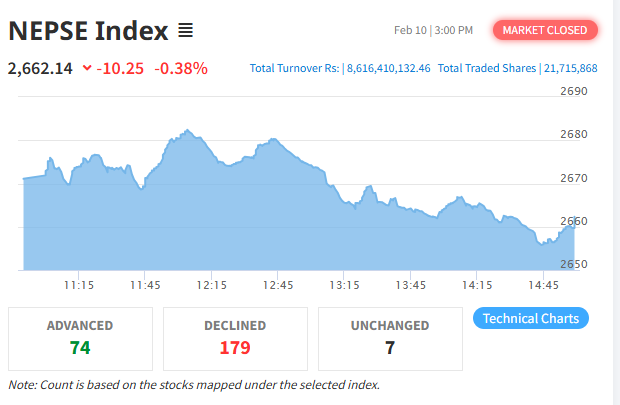

NEPSE TRADING

Ghalemdi Hydro Limited has published its unaudited financial statement for the second quarter of the current fiscal year, showing a sharp increase in losses compared to the same period last year. The latest figures indicate growing financial pressure on the hydropower company despite a modest rise in electricity sales.

According to the report, the company recorded a loss of NPR 17 million by the end of the second quarter of the current fiscal year. In the corresponding period of the previous fiscal year, the loss stood at NPR 1.697 million. This significant rise highlights the company’s continuing struggle to achieve financial stability.

Revenue Growth Fails to Offset Rising Costs

During the review period, Ghalemdi Hydro’s revenue from electricity sales increased slightly, rising from NPR 67.4 million to NPR 69.7 million. This reflects a marginal improvement in power generation and sales performance.

However, the increase in core revenue was not sufficient to compensate for declining income from other sources. The company’s other income dropped sharply from NPR 22.5 million last year to just NPR 2.191 million in the current period, weakening overall earnings.

As a result, total income fell from NPR 89.9 million to NPR 71.9 million, indicating a notable contraction in revenue despite stable electricity output.

Expenses Continue to Rise

While income declined, operating and financial expenses continued to increase. The company’s total expenditure rose from NPR 86 million to NPR 88.4 million during the review period.

Higher administrative, maintenance, and financial costs have placed additional strain on the company’s balance sheet. Analysts say the mismatch between revenue growth and cost control remains a major challenge for the company.

With expenses exceeding total income, the company’s net loss widened further in the second quarter.

Negative Reserves Signal Long-Term Stress

Ghalemdi Hydro currently has a paid-up capital of NPR 1.65 billion. However, its reserve fund remains in negative territory, standing at NPR 253.2 million by the end of Poush.

The negative reserve reflects accumulated losses over previous years and suggests that the company has yet to recover from earlier financial setbacks. This situation limits its ability to reinvest, reduce debt, or expand operations.

Declining Net Worth Raises Investor Concerns

As of mid-January, the company’s net worth per share stood at NPR 95.65, falling below the standard face value of NPR 100. This decline is viewed as a warning sign by market observers, as it indicates erosion of shareholder value.

A net worth below face value often reflects weak profitability and sustained financial stress. For investors, this raises concerns about long-term returns and dividend prospects.

Mixed Outlook for Investors

Market analysts say that Ghalemdi Hydro’s financial performance reflects broader challenges faced by small and mid-sized hydropower companies, including high operating costs, limited income diversification, and debt obligations.

While stable electricity sales provide some support, experts argue that the company must improve cost management and explore additional revenue streams to reverse its declining trend.

Unless operational efficiency improves and expenses are brought under control, analysts warn that continued losses could further weaken investor confidence.

Pressure to Improve Performance

With rising losses, negative reserves, and falling net worth, pressure is mounting on the company’s management to implement corrective measures. Strengthening financial discipline, optimizing production, and reducing non-essential costs are seen as key priorities.

Investors and stakeholders will closely monitor the company’s performance in the coming quarters to assess whether Ghalemdi Hydro can stabilize its finances and return to profitability.

For now, the second-quarter report suggests that the company remains under significant financial strain, highlighting the urgent need for strategic and operational reforms.