Government Moves to Expand Social Security Coverage With Legal, Digital, and Investment Reforms

Author

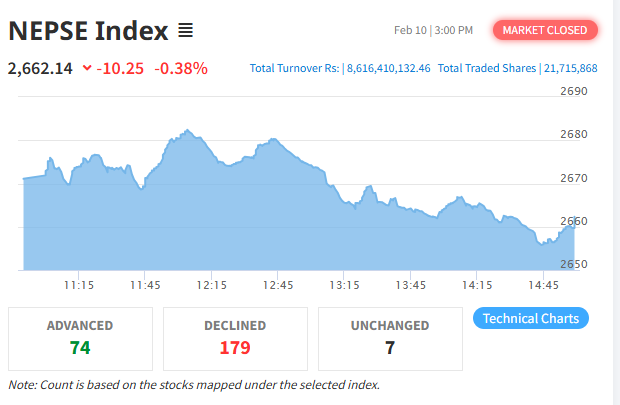

NEPSE TRADING

The government has unveiled an ambitious plan to significantly expand the scope of Nepal’s social security programs, aiming to bring millions of currently excluded citizens under a formal protection framework. Through its newly released Financial Development Strategy, the Ministry of Finance has outlined a multi-layered reform agenda that ranges from legal restructuring and digital payment expansion to investment diversification and institutional coordination.

At the core of the strategy is the government’s recognition that a large segment of Nepal’s workforce—particularly those in the private sector, informal economy, self-employment, and foreign labor markets—remains outside existing social security schemes. The strategy calls for detailed studies to assess how workers and citizens not covered by current funds can be gradually integrated into a unified social protection system.

Toward an Integrated Social Security Framework

The strategy proposes the development of a comprehensive and integrated social security scheme to accommodate citizens who are not currently enrolled in any formal program. Rather than relying solely on fragmented fund-based arrangements, the government plans to review existing schemes and design a more inclusive structure capable of addressing diverse employment realities.

This approach reflects a shift from employer-centric coverage toward citizen-based inclusion, particularly for informal workers who lack stable contracts but remain economically active. Policymakers believe such integration is essential to reduce long-term vulnerability and income insecurity.

Simplifying Contributions Through Digital Payments

One of the key challenges identified in expanding social security coverage is the irregular contribution pattern of migrant workers and self-employed individuals. To address this, the government plans to expand access to digital payment gateways and simplify contribution procedures.

The strategy emphasizes building user-friendly systems that allow contributors—especially those working abroad—to make regular payments with minimal procedural hurdles. By leveraging digital finance infrastructure, the government aims to improve compliance, transparency, and continuity of contributions.

Diversifying Fund Investments to Meet Market Needs

Beyond coverage expansion, the strategy places strong emphasis on improving how social security funds are invested. The government plans to allow funds to invest in a broader range of short-term and long-term financial instruments, aligned with market demand and risk capacity.

This includes reviewing existing legal restrictions to enable investments in specialized investment funds, private equity, and other structured financial products. Officials argue that prudent diversification is necessary to ensure long-term sustainability of social security funds amid rising future liabilities.

Linking Social Security With Housing and Capital Markets

The strategy also seeks to link social security savings with broader economic development goals. One notable proposal is to expand investments in housing and other basic-needs sectors for contributors, potentially through joint housing projects developed in collaboration among funds.

In addition, the government plans to promote closed-end mutual funds, portfolio management services, and other capital-market instruments to channel social security savings into productive sectors, thereby supporting both contributors’ welfare and market development.

Raising Financial and Social Security Literacy

Recognizing that low awareness remains a major barrier to participation, the strategy prioritizes financial and social security literacy. The government plans to launch targeted awareness programs covering the necessity, relevance, benefits, and civic responsibilities associated with social security participation.

By improving public understanding, authorities hope to increase voluntary enrollment, especially among informal workers who often perceive social security as complex or inaccessible.

Strengthening Consumer Protection and Oversight

The Financial Development Strategy also highlights the need to strengthen consumer protection mechanisms related to social security and financial management. This includes developing institutional frameworks to regulate and supervise non-banking financial institutions involved in social security-linked services.

Contracts related to social security programs will be required to clearly outline benefits, risks, claim procedures, and grievance-handling mechanisms in simple and accessible language. The government also plans to establish regulatory and reporting systems dedicated to consumer protection.

Clarifying Roles of Existing Funds

To improve financial stability and reduce institutional overlap, the strategy proposes clarifying the mandates of major social security-related funds, including the Employees Provident Fund, the Citizen Investment Trust, and the Social Security Fund.

The government plans to amend relevant laws to eliminate duplication of roles and, where appropriate, merge programs based on necessity and efficiency. Analysts say clearer institutional boundaries could improve governance and reduce administrative costs.

One-Stop Digital Portal for All Services

As part of its digital transformation agenda, the government aims to develop an integrated information system that allows contributors to access insurance, pension, loan, and investment services from a single portal.

Such a system is expected to improve service delivery, reduce administrative delays, and enhance data integration across funds, supporting evidence-based policymaking.

Focus on Governance, Risk Management, and Transparency

The strategy places strong emphasis on institutional governance. Plans include developing a comprehensive risk management framework covering financial, operational, market, and social security-related risks.

To ensure accountability, funds will be required to strengthen internal control systems and regularly disclose information related to financial status, investments, administrative expenses, and key decisions. Policies to identify and manage conflicts of interest are also part of the reform package.

A Long-Term Shift Toward Inclusive Social Protection

Taken together, the government’s Financial Development Strategy signals a long-term shift toward a more inclusive, transparent, and resilient social security system. If implemented effectively, the reforms could significantly improve protection for informal workers, migrant laborers, and self-employed citizens—groups that have historically remained outside Nepal’s social safety net.

However, experts caution that successful execution will depend on legal clarity, institutional coordination, and sustained political commitment. The coming years will test whether the ambitious strategy can translate into tangible improvements in citizens’ economic security.