Hilton Reinsurance Probe Report Reaches Anti-Graft Body, Action Against Firms Still Uncertain

Author

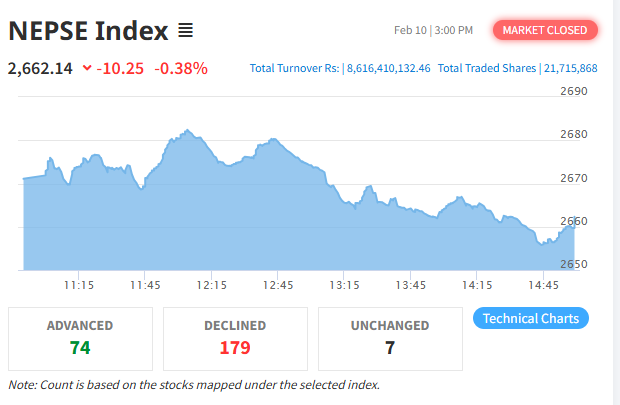

NEPSE TRADING

The investigation report prepared by the Nepal Insurance Authority into the reinsurance dispute involving the international hotel chain Hilton has finally been forwarded to the Commission for the Investigation of Abuse of Authority. The report, prepared amid concerns of large-scale financial irregularities and institutional negligence, was submitted to the anti-graft body through the Ministry of Finance.

The probe was initiated after complaints were filed alleging serious misconduct in the reinsurance of riot and terrorism risks related to Hilton Hotel. The complaints claimed that insurance policies were issued retroactively, bypassing regulatory procedures, in an attempt to process claims worth billions of rupees.

Following the complaint, the CIAA, on Kartik 11, instructed the Nepal Insurance Authority to conduct a comprehensive investigation into the entire reinsurance process.

Initial Report Rejected by Finance Ministry

After completing the investigation, the Authority submitted its first report to the Finance Ministry in Mangsir. However, the ministry returned the document, stating that it lacked clarity.

According to ministry sources, although the report mentioned possible disciplinary actions, it failed to specify which company committed which violations and under which legal provisions they fell. Due to this ambiguity, the report was not accepted.

The ministry then directed the Authority to prepare a revised report clearly detailing company-wise offenses, applicable legal provisions, and proposed actions. After revising the format, the Authority submitted a comprehensive report to the CIAA through the ministry.

Authority Hesitant to Take Disciplinary Action

Despite the investigation confirming regulatory violations, the Nepal Insurance Authority has been struggling to take decisive action against the companies involved.

The report recommends action against four companies: Oriental Insurance, Nepal Reinsurance Company, Himalayan Reinsurance, and Alliant Reinsurance Broker.

Although the matter has been discussed twice in board meetings, no final decision has been reached. Sources say that the involvement of the state-owned Nepal Reinsurance Company has complicated the decision-making process.

Nevertheless, the Authority’s own investigation has concluded that all four firms violated existing insurance regulations during the reinsurance process.

Provisions Under Insurance Act 2079

Under Section 138 of the Insurance Act 2079, companies that conduct insurance business against regulatory directives or submit false information may be fined up to NPR 200,000 for a first offense. Repeat violations may lead to fines of up to NPR 2.5 million and NPR 5 million respectively.

Similarly, Section 134 empowers the Authority to issue warnings, suspend officials, freeze assets, halt dividend distribution, restrict business operations, and even recommend license cancellation through the High Court when necessary.

Background of the Hilton Reinsurance Controversy

The controversy stems from damage caused to the Hilton Hotel Kathmandu during the “Gen-Z” protests on Bhadra 23 and 24. The hotel, backed by the Shankar Group, suffered extensive structural damage, raising the possibility of insurance claims amounting to several billion rupees.

Following the incident, allegations emerged that reinsurance coverage for riot and terrorism risks was arranged retroactively in order to process large compensation claims.

Investigations revealed that insurance worth nearly NPR 5 billion had been issued by Oriental Insurance. However, the mandatory procedure of routing reinsurance through Nepal Reinsurance Company’s pool was not properly followed.

Records show that Oriental Insurance had formally approached Nepal Reinsurance Company for reinsurance. However, the company failed to provide any official response. Subsequently, Oriental transferred the premium through Alliant Reinsurance Broker.

Although Alliant forwarded the premium to Himalayan Reinsurance, Himalayan later claimed that it had rejected the premium related to riot risk coverage.

Findings of the Investigation

The Authority’s investigation concluded that:

Oriental Insurance diverted reinsurance outside regulatory channels,

Nepal Reinsurance Company remained silent on a valid proposal,

Alliant violated regulatory instructions by routing reinsurance improperly, and

All four companies acted in violation of the Insurance Act.

With the report now in the hands of the CIAA, the case has entered a formal legal phase. Observers believe that the next steps taken by regulatory and investigative agencies will be crucial in determining accountability and restoring confidence in Nepal’s insurance sector.