Inflation Eases to 2.42 Percent in Mid-January, Food Prices Pull Down Overall Cost Pressures

Author

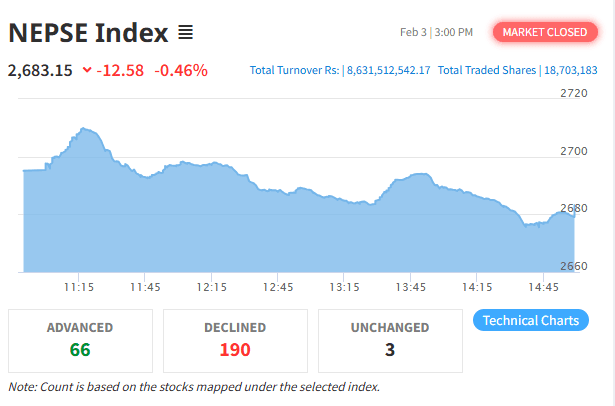

NEPSE TRADING

Kathmandu — Nepal’s annual point-to-point consumer inflation stood at 2.42 percent in mid-January (Poush 2082), reflecting a sharp moderation in price pressures compared to the same period last year. According to Nepal Rastra Bank, consumer inflation had reached 5.41 percent in mid-January of the previous year, indicating that overall price stability has improved significantly over the past twelve months.

A key driver behind the easing inflation has been the decline in food prices. During the review month, inflation in the food and beverage group turned marginally negative at –0.09 percent, a notable reversal from the 7.67 percent increase recorded a year earlier. This decline suggests improved supply conditions and weaker demand-side pressures in essential commodities. In contrast, non-food and services inflation remained relatively elevated at 3.81 percent, though still lower than the 4.19 percent recorded in the same period last year.

On an average basis, inflation during the first six months of the fiscal year 2022/83 stood at 1.70 percent, compared to 4.97 percent in the corresponding period of the previous fiscal year. The data indicates that inflationary pressures have remained contained for much of the current fiscal year, providing some relief to households amid slower economic activity.

Within the food and beverage category, prices showed mixed movements. The annual consumer price index for fruits rose by 5.20 percent, while ghee and oil prices increased by 4.96 percent and non-alcoholic beverages by 3.04 percent. However, these increases were more than offset by price declines in pulses and legumes (–5.52 percent), spices (–3.92 percent), and other food and food-related products (–3.70 percent), contributing to the overall negative food inflation.

Non-food and services inflation was largely driven by sharp increases in specific sub-groups. Prices of miscellaneous goods and services surged by 21.75 percent, while education costs rose by 7.56 percent. Clothing and footwear prices increased by 5.29 percent, tobacco products by 4.15 percent, and alcoholic beverages by 3.85 percent. These figures suggest that while food prices have softened, households continue to face rising costs in services and lifestyle-related expenditures.

Geographically, urban inflation remained higher than rural inflation. During the review month, the consumer price index rose by 2.57 percent in urban areas, compared to 1.99 percent in rural regions. At the provincial level, Madhesh Province recorded the highest inflation at 3.37 percent, followed by Koshi Province at 3.25 percent. Karnali Province saw the lowest inflation at 1.08 percent, highlighting wide regional disparities in price movements.

By ecological region, inflation in the Kathmandu Valley stood at 2.48 percent. The Terai recorded inflation of 2.65 percent, while the Hill region saw a lower rate of 1.94 percent. Inflation in the Mountain region reached 2.66 percent, reflecting variations in supply chains and consumption patterns across regions.

Wholesale inflation, however, followed a different trend. Annual point-to-point wholesale inflation rose to 5.17 percent in mid-January, up from 4.01 percent a year earlier. Prices of intermediate goods increased sharply by 7.07 percent, while wholesale prices of consumer goods and capital goods both rose by 2.58 percent. The wholesale price index for construction materials also increased by 3.48 percent, signaling continued cost pressures in the construction sector.

Meanwhile, wage and salary inflation accelerated during the second quarter of fiscal year 2022/83. The annual wage and salary index increased by 6.03 percent, compared to 2.85 percent in the same quarter last year. Provincially, Gandaki Province recorded the highest wage growth at 9.71 percent, while Karnali Province saw the lowest at 2.00 percent, reflecting uneven labor market dynamics.

In a regional comparison, Nepal’s inflation rate of 2.42 percent in mid-January contrasts with India’s consumer inflation of 1.33 percent in December 2025. While Nepal’s inflation remains higher than India’s, analysts note that it is still within a manageable range. However, persistent increases in non-food prices and wages may pose challenges to maintaining price stability in the months ahead.