IR Department Directs Gold & Silver Traders Not to Use Personal Bank Accounts for Business Transactions; Penalty Up to Rs 10 Million for Violation

Author

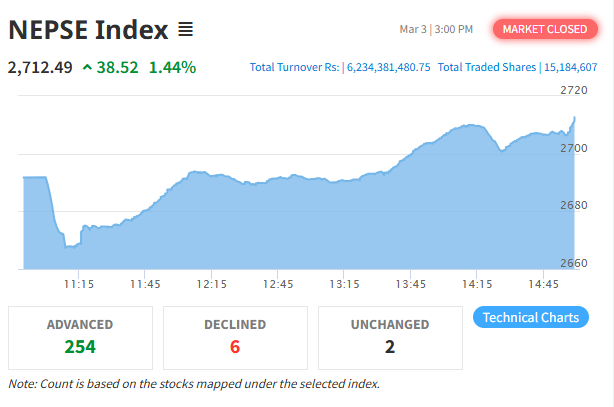

NEPSE TRADING

The Inland Revenue Department (IRD) has issued a strict directive instructing gold, silver, and other precious metal traders not to conduct business transactions through personal bank accounts. The new directive aims to increase transparency, curb tax evasion, and regulate high-value transactions.

According to the notice, any “indicator institution” (businesses dealing in precious metals and valuable items) must conduct all transactions only through bank accounts registered under the business entity.

The department clearly states:

“Indicator institutions shall not use personal bank accounts, or accounts belonging to employees, family members, or any third party for business transactions.”

The directive also imposes stricter rules for high-value transactions:

For the sale of precious metals or goods worth Rs 1 million or more, payment must be received from the customer’s or their family member’s bank account.

All such transactions must be carried out through the banking system only.

If any limitations in electronic payment systems affect such transactions, the IRD has requested Nepal Rastra Bank to make necessary adjustments by referring specifically to these high-value trade requirements.

The directive also outlines severe penalties:

Any business found violating the instructions will face legal action.

In serious cases, a fine of up to Rs 10 million may be imposed.

The government says this move is intended to strengthen transparency in the gold and silver market, prevent tax leakage, and control illegal or unrecorded transactions.