Legal Challenge Filed Against CDSC Chief’s Appointment, Case Reaches Patan High Court

Author

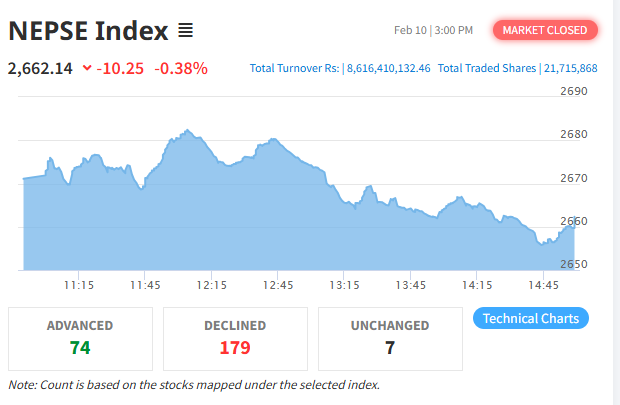

NEPSE TRADING

A writ petition has been filed at the Patan High Court challenging the appointment and continuation of Prabin Pandak as Managing Director and Chief Executive Officer of CDS and Clearing Limited (CDSC). The petition raises serious constitutional and legal questions, arguing that the appointment process violated established laws and governance standards.

The writ was registered on Sunday by senior advocate Uttam Bahadur Shrestha, naming Pandak and seven institutions involved in the appointment process as respondents. The petitioner claims that the decision was unlawful and has adversely affected Nepal’s capital market and financial system.

Allegations of Regulatory and Market Disruption

The petition argues that Pandak’s appointment has contributed to major disruptions in market operations, particularly due to the unresolved dual ISIN (International Securities Identification Number) controversy. According to the filing, the dispute has stalled the share dematerialization process, rendered founder shares inactive, and exposed investors to financial risks worth billions of rupees.

It further claims that administrative inefficiency and weak governance under the current leadership have undermined investor confidence and created operational uncertainty within the securities settlement system.

Court Schedules Hearing on Interim Order

A bench led by Judge Avani Mainali Bhattarai has summoned both parties for a hearing on Chaitra 8 to deliberate on an interim order. The court is expected to examine the legality of the appointment process and assess whether immediate corrective measures are required.

Legal experts say the hearing could play a decisive role in determining whether Pandak will be allowed to continue in office during the ongoing legal proceedings.

Disputed Appointment Process

The CDSC Board appointed Pandak for a four-year term on Poush 14, 2081. However, the writ contends that this decision contradicts the principles of rule of law, good governance, and the employee service regulations of the Nepal Stock Exchange (NEPSE).

According to the petitioner, Pandak is originally a ninth-level employee of NEPSE. Under existing regulations, employees on unpaid deputation are not allowed to serve in external institutions for more than one year. Despite this provision, Pandak was appointed for a full four-year term, which the petition describes as a clear legal violation.

Impact on Investors and Foreign Participation

The writ also highlights the broader consequences of the disputed appointment on the capital market. It claims that nearly NPR 35 billion worth of investor assets have effectively become locked due to administrative delays and unresolved technical issues.

In addition, the petition alleges that the situation has created an undeclared barrier for foreign investors, discouraging cross-border participation and weakening Nepal’s investment climate. Legal uncertainty and operational instability, it argues, have increased market volatility and reduced institutional trust.

Governance and Institutional Accountability in Question

Beyond the appointment itself, the case has raised deeper concerns about governance practices within key market institutions. Analysts note that CDSC plays a central role in clearing, settlement, and securities custody, making leadership credibility and legal compliance crucial for market stability.

The petitioner argues that allowing an allegedly unlawful appointment to continue sets a dangerous precedent and weakens accountability mechanisms across the financial sector.

Awaiting Judicial Direction

The upcoming hearing on Chaitra 8 is expected to determine whether Pandak’s appointment complies with existing legal frameworks and administrative norms. The court may also issue broader guidance on institutional governance and personnel management in public financial bodies.

Legal observers believe the verdict could have far-reaching implications, not only for CDSC but also for regulatory practices across Nepal’s capital market ecosystem. The case has reignited debate over transparency, merit-based appointments, and the enforcement of service regulations in key financial institutions.

As proceedings move forward, market participants and investors are closely watching the court’s response, hoping it will bring clarity and restore confidence in the country’s securities infrastructure.