NEPSE Up by 18 Points; “Twitter Bottom” Valid Despite Lower Turnover

Author

NEPSE TRADING

The NEPSE index closed higher on Tuesday, extending the positive momentum from the previous trading day. After posting a marginal gain on Monday, the market continued its upward move, with the benchmark index rising by 18.37 points to close at 2,619.99.

Despite the rise in the index, total turnover declined. While shares worth NPR 3.44 billion were traded on Monday, Tuesday recorded transactions of NPR 3.29 billion. A total of 7.8 million shares were traded through 55,078 transactions involving 325 listed companies.

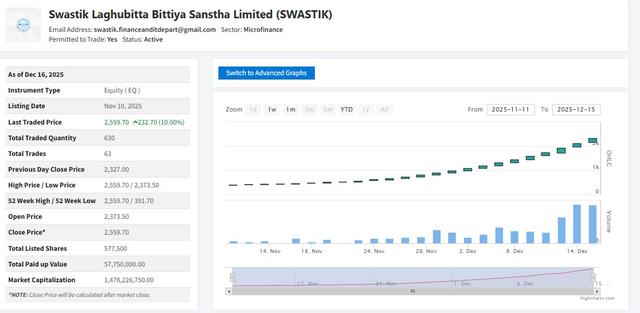

Three companies traded at their positive circuit levels during the session. Shares of Swastik Laghubitta Bittiya Sanstha, Narayani Development Bank, and SY Panel Nepal hit their upper circuit limits. Barahi Hydropower’s share price climbed by more than 7 percent, while Lumbini Development Bank gained nearly 6 percent. In contrast, Shweta Ganga Hydropower and Construction posted the highest decline of the day, shedding 4.16 percent.

In terms of turnover, Ngadi Group Power led the market with share transactions worth NPR 198.2 million. Lumbini Development Bank followed with turnover of around NPR 105 million, while Himalayan Re-Insurance recorded transactions exceeding NPR 95 million.

Out of the 13 sectoral indices, 12 closed in positive territory on Tuesday, while only one sector declined. The Development Bank sub-index posted the strongest gain, rising by 1.56 percent. Similarly, the Hotels & Tourism and Others sub-indices increased by more than 1 percent each. The Trading sub-index, however, witnessed a marginal decline.

Technical Analysis

From a technical perspective, the market generated a “one-candle buy” signal after a long period. According to analysts, the index needed to close above the 2,602 level, which it successfully achieved, triggering a buy signal from a key technical indicator. At market close, the Relative Strength Index (RSI) stood at 52.66, suggesting that investors may still adopt a “wait and watch” strategy. Meanwhile, the formation of a higher high after 11 candles has confirmed the validity of the so-called “Twitter Bottom,” analysts noted.

Broker Analysis

Broker-wise analysis shows a shift in market behavior compared to the previous session. While heavy selling by major brokers was observed on Monday, Tuesday saw strong buying interest from large brokers, supporting the market’s upward move. Among the top 10 brokers, seven recorded relatively higher buying volumes, whereas only three showed comparatively higher selling activity.

Overall, the combination of index gains, broad-based sectoral advances, renewed buying by major brokers, and supportive technical signals indicates improving short-term market sentiment despite the decline in turnover.