Private Sector Credit Growth Remains Sluggish in Second Quarter

Author

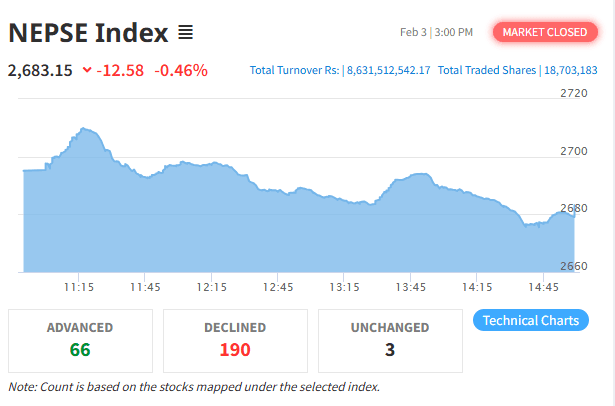

NEPSE TRADING

Kathmandu — Credit flow from banks and financial institutions to Nepal’s private sector has failed to gain the expected momentum in the second quarter of the current fiscal year, indicating continued weakness in domestic economic activity. According to Nepal Rastra Bank, private sector credit increased by only 3.6 percent by mid-January (Poush-end), equivalent to NPR 197.47 billion, reaching a total of NPR 5,695.17 billion.

The data show that credit expansion has remained modest across all categories of banks. By mid-January, lending by commercial banks increased by 3.7 percent, while development banks recorded a 2.9 percent rise and finance companies posted a marginal growth of 1.2 percent. Despite ample liquidity in the banking system, the slow pace of lending suggests that private sector demand for credit remains weak.

In terms of collateral structure, loans backed by current assets (both agricultural and non-agricultural goods) accounted for 15 percent of total outstanding credit at mid-January. Loans secured by real estate continued to dominate, comprising 63.9 percent of total credit. A year earlier, these shares stood at 14.5 percent and 64.9 percent respectively, indicating only a marginal shift away from real-estate-backed lending.

Sector-wise data for the first six months of fiscal year 2022/23 show that credit growth has been concentrated mainly in consumption-oriented and non-productive areas. Lending to the consumption sector rose by 9.1 percent, while credit to the construction sector increased by 7.2 percent. Loans to transportation, communication, and public services grew by 6.2 percent, and industrial production saw a 4.4 percent increase. In contrast, credit to agriculture declined by 1.1 percent, highlighting persistent challenges in channeling finance toward productive sectors.

Growth patterns by loan type further underline the cautious lending environment. Margin lending increased by 8.3 percent over the six-month period, followed by trust receipt (import) loans at 7.8 percent and hire-purchase loans at 7.3 percent. Cash credit rose by 3 percent, while demand and other working capital loans increased by 2.9 percent. Real estate loans, including personal residential housing loans, grew by 2.5 percent, and term loans by 2.4 percent. Overdraft lending, however, declined by 3.3 percent.

In comparison, private sector credit had expanded by NPR 265.56 billion during the same period of the previous fiscal year, underscoring a noticeable slowdown this year. On an annual point-to-point basis, private sector credit growth stood at 6.7 percent at mid-January, a level considered subdued by historical standards.

The composition of total private sector credit has also shifted slightly. By mid-January, non-financial institutional borrowers accounted for 62.7 percent of total credit, while individuals and households made up 37.3 percent. In the same period last year, these shares were 64.2 percent and 35.8 percent respectively, indicating a gradual decline in institutional borrowing.

Economists say the slow credit growth reflects subdued investment sentiment, cautious business expansion plans, and lingering uncertainty in key sectors such as industry and agriculture. While interest rates have fallen to relatively low levels, analysts argue that stronger policy support, improved investor confidence, and targeted incentives for productive sectors will be essential to revive credit demand and accelerate economic activity in the months ahead.