Strong Investor Demand Seen in Hotel Forest Inn IPO as Applications Cross 2.3 Million

Author

NEPSE TRADING

The initial public offering (IPO) of Hotel Forest Inn Limited has drawn strong interest from retail investors, with more than 2.3 million applications submitted during the public subscription period. The IPO was open to the general public from Magh 22 to Magh 26 and witnessed demand several times higher than the shares on offer.

According to preliminary data, a total of 2,330,086 applicants applied for shares worth approximately NPR 2.63 billion. By the final day of subscription, investors had applied for around 26.36 million shares, significantly exceeding the number allocated for public investors.

Issue Structure and Share Allocation

The company had received regulatory approval to issue 4 million shares, representing 20 percent of its issued capital of NPR 2 billion. The total value of the issued shares stands at NPR 400 million.

Out of the total shares, 400,000 units were allocated to Nepalis working abroad, 200,000 units to mutual funds, and 80,000 units to company employees. These shares were distributed in the first phase of the offering.

3.32 Million Shares Offered to the Public

In the second phase, Hotel Forest Inn Limited offered the remaining 3.32 million ordinary shares to the general public. The total value of shares available to retail investors amounted to NPR 332 million.

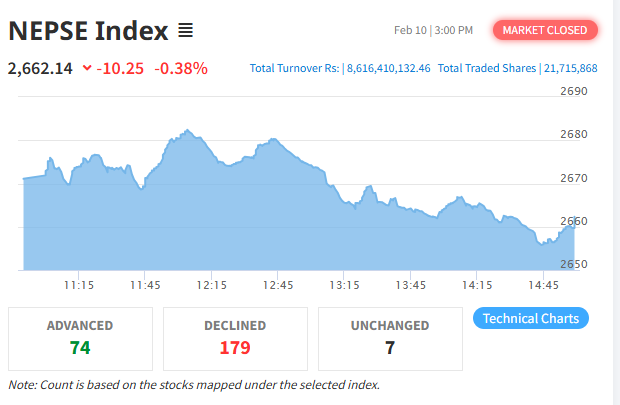

Due to the overwhelming number of applications, the issue has been heavily oversubscribed, indicating sustained retail confidence in IPO investments despite volatility in the secondary market.

Most Investors to Receive Minimum Allotment

The issue manager, NIC Asia Capital, stated that approximately 332,000 applicants are expected to receive shares, each likely to be allotted the minimum of 10 units.

Given the large number of applications relative to available shares, a lottery-based allotment process will be used, meaning the majority of applicants may not receive shares.

IPO Popularity Reflects Market Sentiment

Market analysts say the strong response reflects continued investor preference for IPOs as a relatively low-risk entry point into the stock market. With interest rates declining and uncertainty persisting in the secondary market, retail investors are increasingly turning to primary offerings.

The hospitality sector’s recovery prospects and limited alternative investment opportunities have also contributed to the high demand, analysts note.

The share allotment process is expected to be completed soon, after which the company’s shares will be listed on the Nepal Stock Exchange and made available for secondary market trading.