Unusual Trading in Reliance Spinning Mills Raises Bot Trading Concerns

Author

NEPSE TRADING

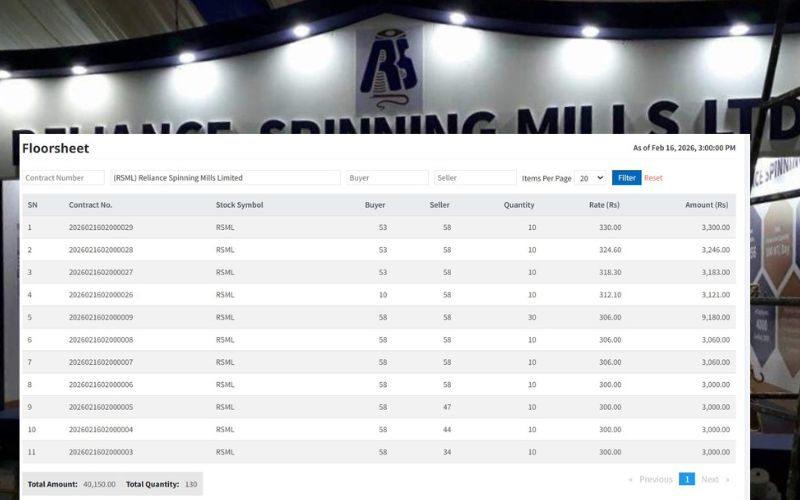

Kathmandu — Unusual trading activity was observed in the shares of Reliance Spinning Mills Limited on Tuesday, raising suspicions of possible bot-based or manipulated transactions in the secondary market.

Although the company’s shares hit the positive circuit limit during the trading session, several transactions were recorded at an unusually low price of NPR 300. This is notable as investors had subscribed to the company’s IPO at NPR 820 per share, meaning some shareholders sold their holdings at a significant loss.

According to trading data, only 130 shares were traded in four separate transactions of 10 shares each, amounting to approximately NPR 40,000 in total value, despite strong upward price momentum. Additionally, four separate trades were executed at the same NPR 300 level.

In total, the company’s shares were traded 11 times during the day. Out of 130 traded shares, 90 shares were purchased through Broker No. 58 alone. Similarly, 8 out of 11 sell transactions were also routed through the same broker, further increasing market suspicion.

Market analysts noted that the stock opened at a price range significantly lower than its IPO value on Nepal Stock Exchange, which may have caused confusion among inexperienced investors. As a result, some new investors sold their shares at a loss without fully understanding market dynamics.

Experts have expressed concern that artificial intelligence tools and automated trading bots may have been used to influence early-stage trading, especially in newly listed companies. Such practices can disadvantage small and retail investors while benefiting a few organized groups.

The incident has once again highlighted the need for stronger monitoring and transparency in the initial trading phase of newly listed companies. Investors have urged regulatory authorities to investigate the suspicious transactions and take necessary action to maintain market integrity.