Gold and Silver Prices Continue to Rise in Nepal, Setting New Records

Author

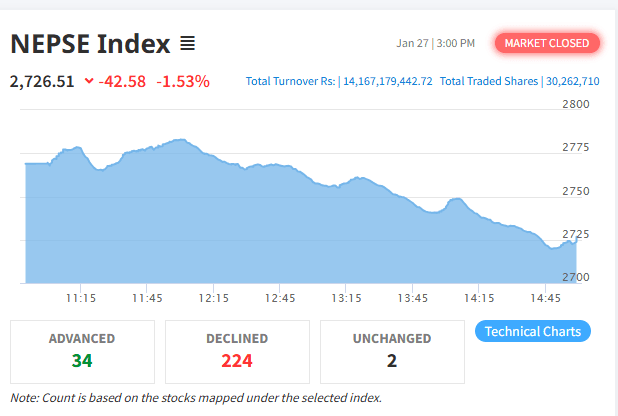

NEPSE TRADING

The prices of gold and silver in the Nepali market continue to rise, setting new records daily. The primary reasons for this upward trend are the increase in gold prices in the global market and the weakening of the Nepali rupee against the US dollar.

Experts suggest that the Nepali rupee, which has a fixed exchange rate with the US dollar, has come under indirect pressure as the Indian rupee weakens. As a result, the US dollar has become more expensive, making gold imports costlier, and leading to a sharp increase in the price of gold in the domestic market.

According to the Nepal Gold and Silver Dealers’ Association, the price of gold reached NPR 309,300 per tola on Tuesday, marking the highest value ever recorded. The price of gold was NPR 309,000 per tola on Monday. Similarly, the price of silver increased by NPR 105 per tola, rising to NPR 6,870 on Tuesday, which is also the highest price ever recorded for silver.

The rise in the price of gold and silver has been influenced by other factors, including geopolitical tensions between the United States and NATO over Greenland, as well as global financial and geopolitical uncertainties. U.S. President Donald Trump’s trade policies have also added to market concerns. On Saturday, Trump warned that if Canada reached a deal with China, a 100% tariff would be imposed.

Gold and other precious metals are considered safe investments, which has led investors to turn to gold during uncertain times. High inflation, a weakening US dollar, increased purchases by central banks worldwide, and the expectation of interest rate cuts by the U.S. Federal Reserve this year have all contributed to the rising demand for gold.

According to Tejaratn Shakya, the former president of the Nepal Gold and Silver Dealers’ Association, the rising global prices of gold have had a direct impact on the Nepali market. As international economic uncertainty and trade tensions increase, investors are being drawn toward gold.

The sharp increase in gold prices has led to a significant decrease in demand for jewelry. Business owners report that due to the high price of gold, the demand for jewelry has almost vanished, and gold purchases through banks have also reduced. With the weakening dollar, countries like China, India, Poland, and Brazil are increasing their gold and silver reserves. As gold becomes a more attractive safe investment, the prices in the international market continue to rise.