IGI Prudential Insurance Reports Increased Losses, Publishes Financial Statement

Author

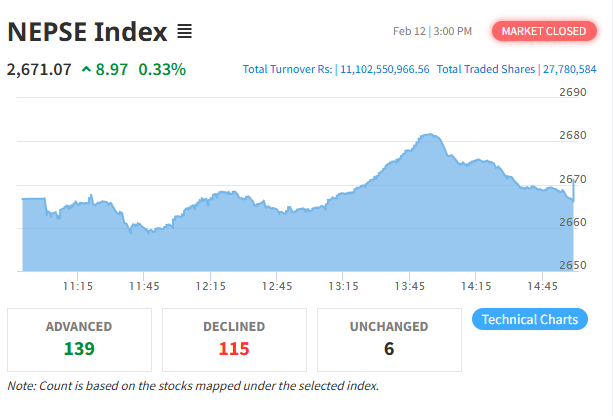

NEPSE TRADING

IGI Prudential Insurance Company has published its unaudited financial results for the second quarter of the current fiscal year 2082/083, showing an increase in losses.

As of mid-December, the company’s profit stood at a negative NPR 181.13 million. In contrast, during the same period last year, the company had a profit of NPR 143 million.

The company attributes the decline in profit primarily to the large insurance claims due to the "Gen Z" movement in August and the floods and landslides in October, which resulted in significant expenses. Despite the impact on profits, other indicators have shown improvement.

In the first six months of the current fiscal year, the company’s earned premium revenue increased by 15.12%. During this period, the company conducted insurance business worth NPR 576.6 million, compared to NPR 500.8 million in the same period last year.

The company’s paid-up capital stands at NPR 3.02 billion, with a negative reserve fund of NPR 175.3 million. The catastrophe fund has accumulated NPR 96.1 million, and the insurance fund holds NPR 7.79 billion.

The company’s total revenue increased by 3.61%, reaching NPR 930.2 million, while total expenses rose by 71.48%, reaching NPR 1.19 billion.

In terms of earnings per share, the company’s EPS decreased by NPR 9.45, standing at a negative NPR 11.96, while the net worth per share is NPR 176.25.

In conclusion, while IGI Prudential Insurance Company’s losses have increased, there has been a positive growth in premium revenue and improvements in other financial indicators, offering hope for future stability and performance.